Ethereum’s price has recently experienced a turbulent ride, surging to ,000 before retracing to ,900 to gather more liquidity. This significant milestone marked the first time since April 2022 that Ethereum reached the ,000 level.

The cryptocurrency’s strong performance can be attributed to several catalysts, including the Dencun upgrade and the anticipation of a spot ETF, setting it apart from Bitcoin. Ethereum has seen a 6% increase in value over the past week, outperforming its peers in the market.

Following a dip below ,000, Bitcoin may be gearing up for a rebound towards pre-halving levels in the range of ,000 and ,000. Meanwhile, Ethereum’s transition to a proof-of-stake consensus mechanism through the Merge upgrade has led to a deflationary status, making it a scarce asset in comparison to Bitcoin.

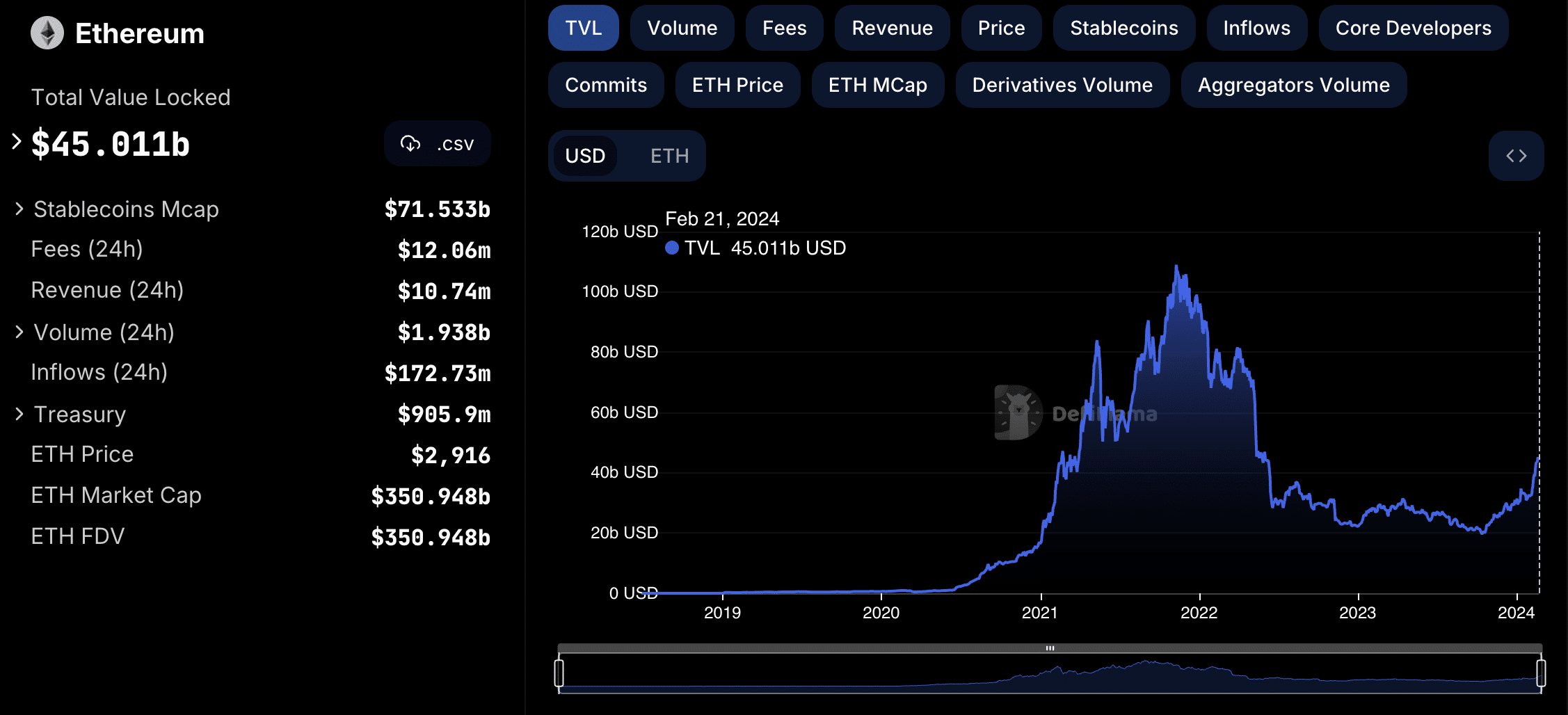

With a significant amount of ETH locked in staking contracts, earning rewards for securing the network, Ethereum’s total value locked (TVL) in decentralized ecosystems has soared to over billion. This trend underscores the bullish sentiment in the market, as investors lock up their holdings to reduce sell-side pressure.

The upcoming Ethereum Dencun upgrade and the increasing hype surrounding a potential spot ETF are key driving factors for a potential parabolic rally in the coming months. Additionally, Ethereum may benefit from the momentum generated by the anticipated Bitcoin halving in April, historically a trigger for bullish runs in both BTC and altcoins.

As Ethereum hovers around ,900, the next critical support level to watch is the green band near ,800. Traders may capitalize on dips to accumulate more Ether before the next breakout attempt above ,000. The technical outlook remains bullish as long as the 50-day Exponential Moving Average (EMA) continues to support price action, signaling a positive trend for Ethereum in the near term.